When it comes to preparing for your golden years, you must understand the differences in retirement savings options. Now, among all the options available, the 401(k) plan is a popular choice for many American employees. But what is a 401(k), exactly?

It’s a retirement savings account that is offered by most employers. With it, you can put a portion of your pre-tax salary into this account, which lowers your taxable income. Further, these savings often grow tax-free until you withdraw them after retiring, ensuring a substantial fund after you retire.

In the next sections, we’ll explore the complex details of 401(k) plans as well as address common concerns and questions. You’ll learn everything from the 401k pros and cons, its types, how much to contribute to what options you have when you leave your job.

So, stay tuned as we simplify the 401(k) plan for you, securing your future.

What is 401(k) plan?

A 401k plan is essentially a handy retirement savings setup sponsored by employers. Here, a portion of your hard-earned money gets put straight from your paycheck into investments like mutual funds — tax-free, at least for now. The best part? It lowers your taxable income for the year, saving you a bit on those dreaded tax bills.

Fast forward to your golden years when you’re ready to relax and enjoy retirement. You can start withdrawing from your 401(k), which might morph into something like an IRA by that time. Even though you’ve got to pay taxes on it then, many find themselves in a lower tax bracket in retirement.

Now that could mean less tax to pay compared to during your working years.

And, why the odd name, 401(k)? Well, it’s named after its specific spot in the U.S. tax code of the 1980s, that’s section 401, paragraph k. Thanks to Ted Benna for bringing this to our attention, we’re now saving for retirement differently. It’s more than just a random number; it’s a key to smart retirement savings.

What are the Advantages and Disadvantages of A 401(k) plan?

There’s no such thing as perks without downsides. 401ks aren’t any different. To make sure you’re on the same page, let’s go over its pros and cons.

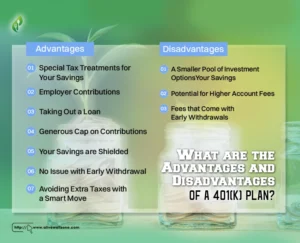

Advantages

Here are some advantages that you’ll enjoy from a 401k plan.

1. Special Tax Treatments for Your Savings

Your savings in a 401(k) enjoy some tax perks. Whether you choose a traditional setup with tax-deferred contributions or go for a Roth where withdrawals are tax-free, you’re getting a deal.

Even capital gains and dividends inside the 401(k) aren’t taxed, allowing for a healthier growth of your nest egg.

2. Employer Contributions

A lot of companies will pitch in, matching a part of what you save — typically between 3% to 6% of your salary. However, this bonus might require sticking around with the company for a few years to fully vest.

3. Taking Out a Loan

If you find yourself in a pinch, you can borrow from your 401(k), up to 50% or $50,000, whichever is less. Just remember, you have five years to pay it back to avoid penalties.

Keep in mind that there may be added income tax owed and a withdrawal fee of 10% if the loan is not repaid on time.

4. Generous Cap on Contributions

When it comes to stashing away money for your golden years, 401(k) plans let you save more than other retirement accounts. In 2022, you could set aside up to $20,500, and the next year, it’s going up to $22,500. If you’re celebrating your 50th birthday or beyond, add another $6,500 in 2022 and $7,500 in 2023 to that amount.

That’s way more than what you can save with an IRA. Plus, there are options for after-tax contributions to boost your savings even more.

5. Your Savings are Shielded

A great thing about 401(k) savings is that they’re largely untouchable by creditors. Sure, there are a few exceptions, like dealing with the IRS or settling divorce assets. However, in most scenarios including bankruptcy or lawsuits, your nest egg remains untouched.

6. No Issue with Early Withdrawal

If you step away from your job at 55 or afterward, you get to access your 401(k) funds straight away, without any penalties. Usually, if you’re younger than 59 and a half, taking money outcomes with a 10% tax.

But leaving your job in the late 50s gives you a golden ticket to avoid that extra charge.

7. Avoiding Extra Taxes with a Smart Move

For people with a higher income, a backdoor Roth IRA is a familiar strategy since they can’t opt for a Roth IRA directly. It involves rolling over contributions from a traditional IRA to a Roth IRA. However, it comes with a tax snag if you have tax-deferred money in a traditional IRA.

The solution? You need to shift those funds to a 401(k) and you sidestep the issue, keeping that backdoor wide open for use.

Disadvantages

A workplace retirement plan has a lot of benefits, but it also has three downsides.

1. A Smaller Pool of Investment Options

401(k) and 403(b) plans may not offer you a sea of investment opportunities compared to taxable brokerage accounts or IRAs. Typically, you’ll find a straightforward selection, think stocks, bonds, and cash funds. no fancy stuff!

On the bright side, fewer options mean you can avoid getting bogged down by too many choices, keeping things simple and focused.

2. Potential for Higher Account Fees

Employer-backed retirement plans often come with a hefty price tag owing to the administrative tasks they involve. Unfortunately, as someone who’s part of the plan, you don’t get much say on the fees, which can be a downside.

But all is not lost, you can still play it smart by opting for options like low-cost index funds or ETFs to keep the fees at the minimum.

3. Fees that Come with Early Withdrawals

Retirement plans come with a clear message – this money is for your post-retirement life. So, dipping into your 401(k) or 403(b) funds before hitting the age of 59½ isn’t encouraged and comes with a 10% penalty.

Moreover, you’ll need a valid reason to access the funds early, so your retirement savings can continue to grow.

What are Some Common 401(k) Mistakes?

Here are the biggest mistakes you can make with your 401(k) —

- Not saving regularly

- Ignoring what your investments are

- Missing out on maximum employer contributions

- Putting too much into company stocks

- Job-hopping before your 401(k) matures

- Early 401(k) fund withdrawals

- Confusion over different 401(k) account kinds

- Daily account balance monitoring

How Many 401(k) Plans Are There?

There are two types of 401k plans: Roth and Traditional

1. Roth 401(k) – A Future-Oriented Choice

When you opt for a Roth 401(k) plan, you’re essentially playing the long game. You won’t enjoy tax breaks immediately on your contributions. But fast forward to your retirement, and you get to withdraw your savings without owing a dime to the tax authorities.

So, if you pitched in $5,000 of your $50,000 earnings into this plan this year, your taxable income remains $50,000. However, retirement comes with the perk of tax-free withdrawals, putting a full stop to tax worries.

2. Traditional 401(k) – For the Self-Employed

As a sole proprietor in the business world, the traditional 401(k) plan, particularly the solo variant, could be your go-to. It’s designed with the self-employed individuals in mind.

Roth or Traditional 401(k): Which to Choose?

Well, it’s not a straightforward answer because it hinges on a few predictions about your future. No worries, we’ve highlighted a few crucial points below. You better take them into consideration and make the choice —

- Your current and future home state

- Possible shifts in Federal and State tax codes

- Your income during retirement

- Your prowess in managing your retirement funds

- Potential changes in the rules governing Roth accounts by the governments

And don’t just take it from here; have a chat with a tax pro before making your move.

How Much Should be 401(k) Contribution?

Deciding the right amount to contribute to your 401k? It’s largely a personal choice based on your individual circumstances. However, we can offer a simple guide to help you set some basic goals.

The 1, 2, 4, 8 Rule

We often advise younger individuals in their 20s to follow the 1, 2, 4, and 8 guidelines for savings. Here’s how it breaks down:

- By 30: Have 1x your annual salary saved

- By 40: Aim for 2x your annual earnings

- By 50: Target 4x your yearly income

- By 60: Strive to save 8x your yearly salary

Besides, factor in social security, and you could potentially retire comfortably in your 60s following this strategy.

Unexpected Factors

Of course, life comes with its twists and turns, including job loss, and entrepreneurial risks. Plus, there are unforeseen expenses, such as medical emergencies, which can alter this plan. Moreover, reaching a retirement-friendly savings amount doesn’t compel you to retire if it doesn’t suit you.

Insuring Your Future

To cap it off, safeguard your financial future with appropriate insurance. That’s why ensure you have a long-term disability and homeowners or renters insurance, and consider life insurance based on your circumstances. This way, you’re not just saving smart but also protecting your assets effectively.

How to Withdraw Money From a 401k After Retirement

Getting closer to retirement, it becomes crucial to think about your income sources. While Social Security will cover a part, it won’t suffice for many to meet all their needs.

So, what can you do?

Well, one solid route is to transfer your 401k into an IRA annuity offering guaranteed lifetime withdrawal benefits. Now, this plan promises a steady flow of income that won’t diminish, lasting your entire life, determined by your account’s value when you retire.

It’s a great way to set yourself up for retirement with a financial cushion. It just needs a bit of forethought!

New Age Rules for Minimum Required Distributions

Good news for US people eyeing their retirement savings! Starting January 1, 2023, the starting age for mandatory withdrawals bumps up to 73, a year more than the previous 72. But wait, come January 1, 2033, it takes another leap to 75!

Well, this change comes as a breath of fresh air, especially if you’re hustling to boost that retirement nest egg a bit more while you’re still working. You’ve got extra time now to let your savings sit and grow, since these accounts are tax-deferred, though not completely tax-free.

But here’s a little heads up: while delaying could mean your savings pot grows a bit fuller, it could also lead to heftier tax bills down the line. You’ll be pulling out larger sums in a shorter time frame later on.

So, while it’s a relief for many, it’s always a good strategy to keep an eye on the potential tax hits in the future.

Big Changes to Retirement Plans in the Pipeline

In 2025, automatic enrollments will start. They’ll be for new 401(k) and 403(b) plans. Here, the starting rate is 3-10% of your pay. Each year, this rate increases by 1%. The max rate will be 10-15%.

Now, for 50 and older workers, there’s more. You can add an extra $7,500 annually to your retirement stash. And if you are between 60 and 63, you can up that to $11,250 or more from 2025.

Lastly, got a Roth 401(k) plan? Big news! From 2024, you can skip required distributions.

So, keep these dates in mind, guys!

Is the 401k Better Than a Pension Plan?

We hold our 401(k) close because it’s indisputably yours, offering a security that no one can snatch away. Anyway, here are our three central reasons why we view that 401(k) plan stands taller —

- Ownership is Real: Your money in a 401(k) is genuinely yours, not just a promising figure on a ledger earmarked for the future.

- Transparency and Security: With a 401(k), you know the exact amount you have at any moment. In contrast to many pensions, it doesn’t rely on future money, which could disappear due to mismanagement.

- Better Returns: Typically, 401(k)s offer more robust returns than pension funds. You get more investment options and the freedom to choose your risk level, unlike pension funds with their one-size-fits-all strategy.

Drawing from our experience, we’ve seen many being let down by pension funds not once, but twice. The company’s failures led to the unfair distribution of the remaining pension funds, tossing seniority aside.

Frequently Asked Questions

1. What is the Ideal Contribution to My 401k?

Understanding how much to contribute to your 401k is crucial. If your employer matches your contributions up to a specific limit, make sure you contribute enough to get the full match, since it’s essentially free money.

2. What are the Withdrawal Norms for a 401k?

There are annual restrictions on your contributions, but not on the withdrawal amount. When the time comes to retire, you can start withdrawing from your 401k to finance your retirement. Generally, you can initiate qualified distributions from the age of 59 and a half.

However, premature withdrawals might incur taxes and penalties.

3. What happens to my 401k if I resign?

If you decide to leave your job, you have several options regarding your 401k. You can either withdraw the accumulated amount, transfer it into an IRA, or leave it with your previous employer. Now, each option carries its own set of advantages and disadvantages, so it’s recommended to consider each carefully before making a decision.

Final Words

While discussing 401(k) plans, we touched on several questions that are often asked by employees. By now, the query “What is a 401(k)?” should have an answer in terms of its definition. Hopefully, you now have a better idea of how it works and what it can do for your finances.

Look, it’s clear that a 401(k) is not just a retirement savings account, but a tool that can help you achieve a stable retirement if you use it wisely. From figuring out what amount to contribute to understanding withdrawal norms, it’s a great place to start.

As we conclude, remember that a well-managed 401(k) can be your reliable ally in creating a financial future that’s more than a dream. Now that you have the knowledge we discussed, you can take confident steps toward managing your 401(k) plan effectively. To know more follow Alivewellzone