Health insurance is more than just a safety net for medical expenses. It’s a shield for your family’s health and financial well-being. Therefore, knowing the truths about health insurance is important.

Why? If you don’t understand, you may pay too much or have insufficient coverage. Besides, it’s a subject that often attracts interest due to its significant impact on our lives. Thus, we’ll clarify the facts about health insurance, enabling you to make informed decisions.

Moreover, we’ll share major tips so you can choose the most appropriate plan. Read on!

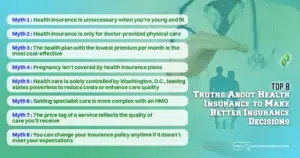

Top 8 Truths About Health Insurance to Make Better Insurance Decisions

Even though there are many myths and misconceptions surrounding health insurance, you must be aware of the most common ones. In the following sections, we’ll clarify some noteworthy myths and provide you with the facts.

Myth 1: Health insurance is unnecessary when you’re young and fit

Truth

It’s a common belief, but unfortunately, it’s not accurate. Regardless of age or health, no one is exempt from unexpected health issues or accidents. It’s impossible to predict when these might occur.

The reality is, that health can take a surprising turn at any moment, regardless of how old you are. The financial implications can be substantial, potentially running into tens of thousands of dollars.

Having health insurance provides a safety net for these unforeseen circumstances. It offers peace of mind during difficult times, knowing that you’re covered if something does happen.

Plus, it’s worth noting that the ACA imposes penalties on those who can afford health insurance but opt not to have it. So, it’s not just about health, it’s also about financial responsibility.

Myth 2: Health insurance is only for doctor-provided physical care

Truth

This is a common misunderstanding, but it’s not the whole picture. In addition to physical health services, health insurance covers mental health and alternative treatments as well.

Your health plan isn’t just about physical health. It also includes benefits for mental health and behavioral health. Plus, many health plans cover non-traditional medical options such as acupuncture and chiropractic.

Moreover, some plans go beyond the norm and offer discounts on holistic treatments and programs that promote overall wellness.

Take, for instance, Harvard Pilgrim’s Living WellSM Everyday program. It goes beyond the usual wellness offerings and promotes activities like

- Financial mindfulness

- Volunteering

- Meditation

- Self-care

- stress management

- Environmental wellness

Your health plan encourages proactive measures for physical and emotional well-being, such as exercise. Harvard Pilgrim provides online fitness classes and gives you back up to $300 if you sign up for an online fitness class, gym, or a similar place. They offer —

- Group classes

- Strength training

- Kickboxing

- Personal training

- Indoor rock climbing

- Tennis

However, approval for these facilities and virtual fitness subscriptions is subject to Harvard Pilgrim’s discretion.

Myth 3: The health plan with the lowest premium per month is the most cost-effective.

Truth

While it might seem logical to assume that a health plan with the lowest premium per month is the most affordable health insurance plan, this isn’t always the case. The actual cost of a health plan depends on the healthcare needs of the individual or family it covers.

If you’re in good health and don’t require frequent medical attention, choosing a low premium might indeed be your best option. The cost of a higher premium plan with more extensive coverage can be worth it if you require regular medication and doctor visits.

If you have a high-deductible health plan that qualifies under federal rules, consider opening a Health Savings Account (HSA). This account allows you to set aside pre-tax income for certain healthcare expenses. An HSA-compatible health plan may even contribute to the account to help with out-of-pocket costs.

Myth 4: Pregnancy isn’t covered by health insurance plans.

Truth

It used to be the case for many individual insurance plans, but things have changed. Under the Affordable Care Act (ACA), all Marketplace and Medicaid health plans now include pregnancy and childbirth coverage.

Moreover, most plans provided by employers also cover pregnancy.

For example, Blue Cross Blue Shield of Alabama offers a unique service for expecting mothers. They can download the Baby Yourself app, which provides pregnancy tracking features, useful tips, and quick access to a doctor or nurse with just a button press.

Myth 5: Health care is solely controlled by Washington, D.C., leaving states powerless to reduce costs or enhance care quality.

Truth

Contrary to this belief, states do have the power to influence healthcare costs and quality. They can do this by providing patients with more options for pre-paid, insurance, or other service arrangements.

One such model is Direct Primary Care (DPC), which reduces insurance overhead and allows doctors to spend more time with patients. House Bill (HB) 886, proposed by Rep. Seth Grove, clarifies that DPC should not be regulated as insurance, providing much-needed clarity for the industry.

States also can expand telemedicine, which can lower costs and increase access to care. The pandemic led to temporary waivers requiring insurance companies to reimburse telemedicine services and allowing out-of-state practitioners to treat Pennsylvania patients.

Myth 6: Getting specialist care is more complex with an HMO.

Truth

In an HMO, you first consult with the Primary Care Physician (PCP) for a referral to a specialist. It isn’t a hindrance, but rather a way to simplify your care.

Imagine you’re dealing with ongoing digestive problems. With an HMO, you’d first talk to your PCP. It might seem like an extra step. However, your PCP knows your health history well, which helps them guide your care effectively.

Your PCP can suggest the right specialist for you, and might even help you get an appointment sooner than you would if you contacted a specialist yourself.

Thanks to telemedicine, you can have these consultations at home. For example, Harvard Pilgrim has an online PCP plan, SimplyVirtual, that lets you get PCP referrals and use tons of other stuff on your mobile device.

Currently, this service is limited to members and employers in Connecticut, but it’ll soon be available to members outside of the state.

Myth 7: The price tag of a service reflects the quality of care you’ll receive.

Truth

Many people think that the cost of a doctor’s visit is a good indicator of the quality of care. However, this isn’t always the case. Doctor’s fees can vary widely, but a higher fee doesn’t mean better care. In fact, you’ll often find top-notch services, like

- Office visits

- Radiology services

- Lab tests

And a few outpatient surgeries and procedures, at more budget-friendly providers. Sticking with an in-network provider to get these services can help you keep your out-of-pocket expenses down.

To help you estimate the cost of your appointments before you get any treatments, Harvard Pilgrim provides a tool called Estimate My Cost. With this tool, you can make well-informed choices about healthcare providers.

Myth 8: You can change your insurance policy anytime if it doesn’t meet your expectations.

Truth

Many people believe they can change their health insurance policy anytime they want. However, this isn’t exactly true.

You can only switch your policy during the annual enrollment period. In other words, unless there is a major event in your life or a change in your job that changes your employer-provided health coverage.

This can be tough for someone who was healthy when they signed up and chose a low-cost, high-deductible policy, thinking they wouldn’t use it. If they unexpectedly get sick or injured, they have to wait until the next year to change their policy.

Choosing the Right Health Insurance Plan for Your Family

Don’t let misunderstandings stop you from getting a health insurance plan for your family. In reality, finding the right plan can be a positive experience. Here are some easy-to-follow tips —

Check Your Doctor Visits

If you and your family see the doctor often, go for a plan that has fewer out-of-pocket costs, even if it means paying more each month. But if you don’t see the doctor much, something with a lower monthly cost might be a better fit.

Look At Your Medication Needs

If anyone in your family needs regular prescription medicine, make sure to check a plan’s list of covered drugs before you sign up. It’ll make sure your necessary medicines are covered.

Decide On Your Costs

What matters more to you, paying less each month or having a lower deductible? Your choice will probably depend on how often you need medical care. If you only go for check-ups and don’t have young kids, then a higher deductible and lower monthly cost could be the best choice.

Think About Your Family’s Future

If you’re thinking about big life changes like getting married or having a baby, these could change what you need from a health plan. Along with that, you should also analyze, does your insurance covers ambulances and all?

Keep in mind that the people on your health plan can affect costs and the services you should look for.

Start Looking Early

Health insurance plans have set times when you can sign up, usually between November and January each year. Be ready to look at plans that could work for you before this time starts.

Final Words

Understanding truths about health insurance is key to making smart choices. You need to know that health insurance is important for everyone, young and old, healthy or not. It goes beyond simple doctor visits and includes things like pregnancy care.

Also, plans with a low monthly premium might not always save you money. Plus, actions at the state level can affect the quality and costs of your healthcare. So, when you choose health insurance, think about how often you see your doctor, your medication needs, and your budget for healthcare costs.

All in all, analyze how different plans match up with what you need from your healthcare. If you take this cautious approach, you can find a plan that fits both your health needs and budget.

FAQs

Is it worth it to buy insurance?

Yes, health insurance is a smart investment in your healthcare. It helps keep you and your family healthy and makes it easier to cover medical costs. Being uninsured can lead to serious health risks, so it’s always beneficial to have insurance.

Who needs health insurance the most?

Two groups need health insurance the most. Firstly, young adults aged 18 to 24 due to their high uninsured rate of 29%. Secondly, midlife adults aged 55 to 64. Even though their uninsured rate is below average at 14%, their family incomes are generally decreasing, and they are likely to need more health services.

Who pays for healthcare in the US?

In the US, public insurance programs like Medicare, Medicaid, CHIP, and military health insurance programs (Veteran’s Health Administration, TRICARE) are funded by federal taxes.