Last Updated on December 3, 2024 by Helena Akter

Ever found yourself overwhelmed by the different types of health insurance plans available? With an abundance of options and rising healthcare costs, it can be difficult to choose the right plan. Plus, a lack of understanding of health insurance plans can lead to unplanned expenses.

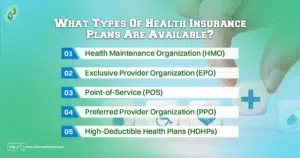

Now, there are several plans to choose from, including HMO, EPO, POS, PPO, and HDHPs, each with unique provider options and costs. Choosing the right plan depends on preferred doctors, affordability, and coverage needs.

So today, we’ll break down the different kinds of health insurance, including HMOs, PPOs, EPOs, and more. You’ll gain insights into the key features, pros, and cons of each plan. Hence, you can make an educated choice that suits your lifestyle and health priorities.

What Types Of Health Insurance Plans Are Available?

We meticulously researched the various health insurance options and shortlisted the most common ones. The factors we looked at were coverage, cost, flexibility, and their specific needs.

So, let’s go deeper into these plans to help you make an informed choice.

1. Health Maintenance Organization (HMO)

Health Maintenance Organization (HMO) plans let you access health care from a specific list of providers. If you need care outside this network, it usually won’t be covered, except in emergencies.

Plus, you’ll need to live or work in the area the HMO serves. When you join, you pick a primary care provider (PCP) who coordinates your health care. If you need to see a specialist, you’ll probably need a referral from your PCP.

With an HMO, you get a wide range of healthcare services. You might pay a small amount, called a co-pay when you visit your PCP or a specialist. Often, there’s no co-insurance or deductible for staying in the hospital.

Who Can You Visit?

You can see any doctor in the HMO network. However, going outside the network means you might have to pay the full cost yourself, except for emergency services. Even in an emergency, doctors at the hospital who aren’t part of the network might charge you.

What you pay —

- Premium: This is what you pay every month for your insurance.

- Deductible: You might have to pay a certain amount before your insurance starts covering your care, but preventive care is usually not subject to the deductible.

- Co-pays and Co-insurance: For different services, you might pay a fixed amount (co-pay) like $15, or a percentage of the cost (co-insurance), like 20%. These payments are part of what you must pay before your deductible is met.

- Paperwork: With HMOs, you usually don’t have to worry about filling out claim forms.

2. Exclusive Provider Organization (EPO)

An Exclusive Provider Organization (EPO) plan is a type of health insurance where you get coverage only if you visit doctors and hospitals within the plan’s network. Unlike some other plans, you don’t need to pick a primary care doctor or get referrals to see specialists.

But remember, emergency services are always covered, even if the provider isn’t in your network.

Who Can You Visit?

You can see any doctor or specialist within the EPO network. There’s no coverage if you go outside the network.

What Are the Costs?

- Premium: This is what you pay every month to have the insurance.

- Deductible: Some EPO plans might have a deductible, which is the amount you need to pay before your insurance starts to cover costs.

- Copay or Coinsurance: A copay is a set fee you pay for services, like $15 for a doctor’s visit. Coinsurance means you pay a part of the cost for care, such as 20%.

- Out-of-Network Costs: If you choose to see a doctor outside the network, you’ll be responsible for the entire bill.

- Paperwork: EPO plans usually involve minimal paperwork.

This simplified setup means you have the freedom to see specialists without extra steps, but you need to stay within the network to be covered.

3. Point-of-Service (POS)

A Point-of-Service (POS) plan is a mix between an HMO and a PPO. In this type of health insurance plan, you have the option to pick a primary care doctor within the plan’s network.

This doctor can then refer you to specialists as needed. Unlike some plans, a POS allows you the flexibility to seek care outside the network, though this comes with higher costs. Plus, referrals from your primary care doctor are necessary if you want to see a specialist.

Who Can You Visit?

You can visit doctors within the network based on your primary care doctor’s referrals. While different types of health insurance plans offer various levels of flexibility, POS plans let you see out-of-network doctors but expect to pay more.

What Are the Costs?

- Premium: This monthly payment keeps your insurance active.

- Deductible: Before your insurance covers more extensive services, you might have to meet a deductible, especially for out-of-network care, which could be higher.

- Copays or Coinsurance: For each visit or service, you’ll either pay a copay (a fixed amount like $15) or coinsurance (a percentage of the service cost). These costs increase if you opt for out-of-network care.

- Paperwork: If you choose out-of-network services, you’ll need to pay upfront and then submit a claim to your POS plan for reimbursement.

4. Preferred Provider Organization (PPO)

A Preferred Provider Organization (PPO) plan gives you the freedom to see doctors outside the network, though staying within the network saves you money. In fact, when it comes to small business health insurance plans, PPOs are often preferred the most.

Unlike other plans, you don’t need to pick a primary care doctor or get a referral to see specialists, even outside the network.

Who Can You Visit?

You’re free to see any doctor within the PPO network. If you choose doctors outside the network, expect higher costs.

What Are the Costs?

- Premium: The monthly amount you pay for your insurance.

- Deductible: Some PPO plans include a deductible, which can be higher for out-of-network services.

- Copay or Coinsurance: You might pay a fixed fee (copay) like $15 for a service, or a percentage (coinsurance) of the service cost, such as 20%.

- Additional Costs: If an out-of-network doctor’s charges are higher than typical in your area, you may need to cover the difference after your insurance contribution.

- Paperwork: Seeing in-network doctors involves minimal paperwork. For out-of-network care, you’ll pay upfront and submit a claim for reimbursement.

Despite higher premiums and out-of-pocket costs, their flexibility in provider choice makes them the best health insurance plan for families for individuals who value freedom.

5. High-Deductible Health Plans (HDHPs)

Any health insurance plan, whether it’s an HMO, POS, EPO, or PPO, can be set up as a high-deductible health plan (HDHP). These plans come with high deductibles, meaning you’ll pay more upfront for healthcare before your insurance kicks in.

However, the upside is that HDHPs often have lower monthly premiums and allow you to use a Health Savings Account (HSA). An HSA is a special account that offers tax benefits for saving money to pay for medical expenses not covered by insurance.

Understanding HDHP Costs

- Minimum Deductible: For 2023, individual plans require a minimum deductible of $1,500, while family plans require $3,000.

- Maximum Out-of-Pocket: Your total out-of-pocket costs won’t exceed $7,500 for individual plans or $15,000 for family plans in a year.

Who Can You Visit?

The types of health insurance plans in US determine which doctors you can see and how you access specialists.

What Are the Costs?

- Premium: HDHPs typically charge lower monthly premiums compared to other types of plans.

- Deductible: You must meet a deductible of at least $1,400 for an individual or $2,800 for a family plan before insurance covers more services. Preventive care, however, is free from the start.

- Copays or Coinsurance: Except for preventive care, you’ll pay all costs up to your deductible. You can use HSA funds for these expenses.

- Paperwork: Save your receipts to manage HSA withdrawals and track deductible expenses.

Benefits of an HSA

An HDHP paired with an HSA offers tax advantages —

- Contributions to your HSA are tax-deductible.

- The money in the HSA grows tax-deferred, meaning you won’t pay taxes on the interest or earnings.

- Withdrawals are tax-free when you use them for eligible medical expenses.

For 2023, individuals can contribute up to $3,850 to an HSA under an individual health plan, and those with family plans can contribute up to $7,750. These contributions can significantly lower your taxable income while providing a financial buffer for medical costs.

What’s the Best Type of Health Insurance?

Choosing the best type of health insurance depends on your personal needs and what you value most in coverage. There’s no one-size-fits-all answer, as each plan has its strengths and weaknesses.

When you compare types of health insurance plans, you can better understand which plan aligns with your health care preferences and financial situation.

PPO vs. HMO: How They Compare

- Premium Costs: PPO plans tend to have higher monthly premiums compared to HMO plans.

- Flexibility in Choosing Providers: PPOs give you more freedom to visit doctors and hospitals of your choice, unlike HMOs, which limit you to a network.

- Out-of-Network Coverage: While HMOs rarely cover care outside their network, PPOs might cover a part of these costs.

- Specialist Referrals: Unlike HMOs, PPOs don’t require you to get a referral to see a specialist.

HMO vs. EPO: How They Compare

- Premiums: Generally, HMO plans offer lower premiums than EPO plans.

- Out-of-Network Care: Both HMOs and EPOs typically do not cover care outside their network.

- Referrals for Specialists: HMOs need a referral for you to see a specialist, whereas EPOs do not.

- Rates with Providers: EPOs negotiate lower rates within their network, while HMO providers are either employed by the HMO or under contract.

PPO vs. POS: How They Compare

- Out-of-Network Care: Both PPO and POS plans let you seek care outside their network, but it’ll cost you more than staying within the network.

- Premiums: POS plans usually cost less each month compared to PPO plans.

- Seeing a Specialist: You don’t need a referral for specialists with a PPO plan, but you do with a POS plan.

PPO vs. EPO: How They Compare

- Out-of-Network Coverage: EPO plans won’t cover care outside their network, while PPOs will cover part of these costs.

- Premium Costs: EPO plans tend to have lower monthly payments than PPOs.

- Choice of Providers: PPO plans give you access to a broader range of doctors and hospitals than EPO plans.

EPO vs. POS: How They Compare

- Referrals for Specialists: EPOs usually don’t require a referral to see a specialist, unlike POS plans.

- Out-of-Network Care: With a POS, you might get some coverage for out-of-network care, which you generally won’t get with an EPO.

- Premiums: Both EPO and POS plans often come with lower premiums compared to PPO plans.

HMO vs. POS: How They Compare

- Out-of-Network Care: With a POS plan, you have the option to get medical care outside the network, something that’s usually not covered if you have an HMO.

- Premiums: Both HMO and POS plans are generally more budget-friendly than PPO plans, thereby appealing to those seeking affordable coverage.

- Seeing a Specialist: Need to see a specialist? Both HMO and POS plans will require a referral from your primary care doctor.

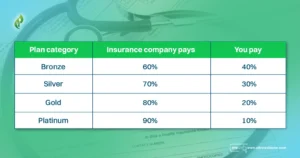

Types of Health Plan Categories

When looking into health insurance through the federal Health Insurance Marketplace, created after the Affordable Care Act (ACA), you’ll pick from four tiers: Bronze, Silver, Gold, and Platinum.

Each category balances monthly premiums against the costs you’ll face when you need medical care.

Bronze

- Monthly Premium: This is the lowest among all tiers.

- Costs When You Need Care: Expect to pay the most out-of-pocket for healthcare services.

- Deductibles: You might need to pay a significant amount before your insurance starts covering costs.

- Ideal For: Those seeking an affordable health insurance plan to guard against severe health issues without worrying about routine care costs.

Silver

- Monthly Premium: This is moderate, higher than Bronze but lower than Gold and Platinum.

- Costs When You Need Care: Your out-of-pocket costs will be moderate.

- Deductibles: Lower than Bronze, meaning your plan starts contributing sooner.

- Ideal For: If you’re eligible for extra savings or prefer to pay a bit more each month to have more of your routine healthcare covered.

Gold

- Monthly Premium: Expect to pay a high amount every month.

- Costs When You Need Care: When you need medical services, your out-of-pocket costs will be low.

- Deductibles: These are low, so your insurance begins to cover costs sooner.

- Ideal For: If you frequently need medical care, paying more each month to lower your costs for treatments and procedures makes sense with a Gold plan.

Platinum

- Monthly Premium: This is the highest premium among all the tiers.

- Costs When You Need Care: Your costs when getting care are the lowest compared to other plans.

- Deductibles: Very low, so insurance starts contributing almost immediately.

- Ideal For: Perfect if you often need medical attention and prefer to pay the highest monthly premium to ensure most of your healthcare expenses are covered.

You’ll pay these average charges at each level —

| Plan category | Insurance company pays | You pay |

| Bronze | 60% | 40% |

| Silver | 70% | 30% |

| Gold | 80% | 20% |

| Platinum | 90% | 10% |

How to Choose the Right Health Insurance Coverage

Finding the right health insurance starts with knowing what’s available. Once you’re up to speed on the types of health insurance plans in the US, analyze your health needs and financial situation to pinpoint the best match.

Consider these questions —

- How’s my overall health?

- What monthly premium fits my budget?

- Do I have, or am I likely to develop, any conditions that need ongoing care?

- Can my savings handle high deductibles if I opt for a plan with lower monthly costs but higher out-of-pocket expenses?

- Will I or anyone on my plan need specialist care?

- Am I okay with using only doctors and hospitals in a plan’s network?

- Are added benefits like vision or dental coverage important to me?

Thinking about a Health Savings Account (HSA) is also smart. HSAs come with tax perks and let you roll over unused funds year after year. After turning 65, you can take money out for any reason, paying only income tax on withdrawals, making HSAs a savvy retirement saving tool.

Conclusion

Picking the right health insurance plan helps you take care of your health needs without spending too much. You have several options: Health Maintenance Organizations (HMOs) limit you to specific doctors, while Preferred Provider Organizations (PPOs) let you choose more freely.

Besides, you can save on premiums and taxes with High-Deductible Health Plans (HDHPs) combined with Health Savings Accounts (HSAs). However, it’s key to choose a plan that matches your health care needs, how much you can afford, and how much freedom you want in picking your health care providers.

Think about what you’ll have to pay in premiums, deductibles, and co-pays, and which doctors you can see. Spend some time comparing the types of health insurance plans available to you. The right plan for you depends on your health, financial situation, and the type of health care you expect to need.

Types of Health Insurance Plans FAQs

What Are Medicare and Medicaid?

Medicare is a health insurance program run by the government for people 65 and older and for those under 65 with certain disabilities. Medicaid, on the other hand, helps people with low income afford healthcare, and it’s managed by the states.

What Is COBRA Insurance?

COBRA insurance lets you keep your current health insurance for a while after losing your job or when you can no longer get health benefits from work. For instance, if you’re laid off, quit, or retire, COBRA could be an option. Remember, you’ll have to pay all your premiums yourself, plus your employer’s extra charge, so the total cost can reach 102% of the original plan!

Why do doctors prefer PPO?

Doctors lean towards PPO plans often because they get paid more than with HMO plans and deal with fewer paperwork hassles. A PPO plan’s freedom to choose doctors and its comprehensive coverage are big pluses, despite the higher premiums you might pay.

Is it better to have a higher copay or deductible?

A higher copay is better if you want lower monthly costs and can handle occasional higher payments for care. Deductible is better if you prefer lower overall costs for major health events, despite higher initial expenses.