Last Updated on December 5, 2024 by Helena Akter

Finding the right health insurance can be confusing and frustrating. With so many options, how do you even begin to choose? You start by asking yourself – which health insurance plan is best for me?

HMOs have lower premiums but fewer doctor choices. PPOs have wider doc choice but higher costs. EPOs limit doctors without referrals. POS blends HMO and PPO features. HDHPs work well with HSAs to save taxes if your health costs are low. Catastrophic plans are best for those under 30 or hardship exempted.

That’s why, we’ll walk you through the key factors that determine which health insurance plan fits your situation best. By the end, you’ll have a checklist to analyze any insurance policy. Moreover, you will know what questions to ask for the best medical insurance.

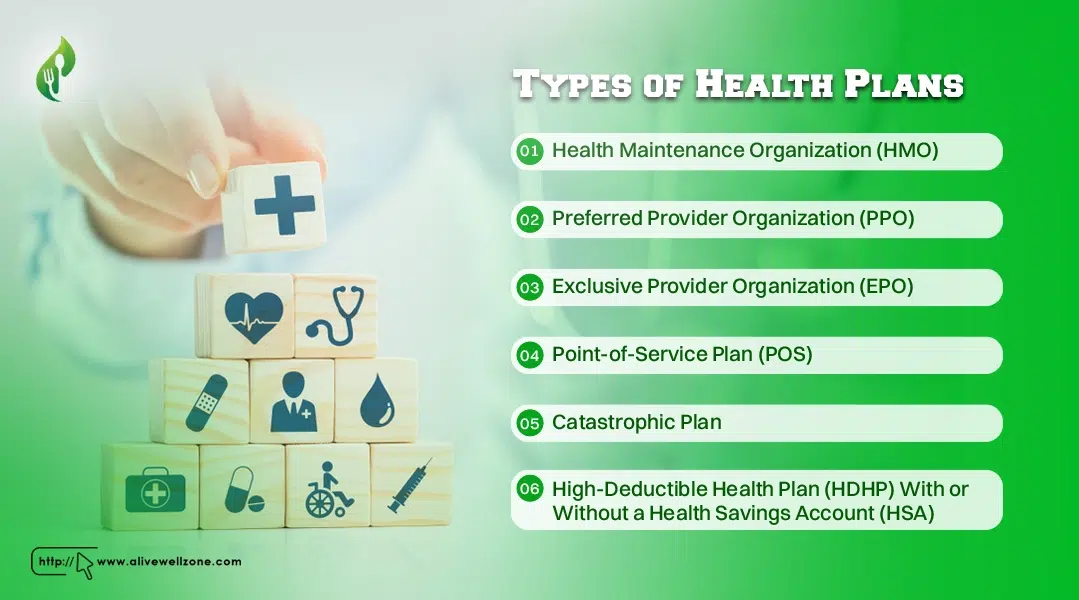

Types of Health Plans

Take a moment to understand the differences between types of health plans. Knowing these can assist you in selecting a plan that suits your budget and health care requirements.

For detailed information on a specific plan, review its benefits summary.

1. Health Maintenance Organization (HMO)

With an HMO, you can only see doctors in their network, except in emergencies.

Pros

- Lower costs

- Little paperwork

- A primary doctor coordinates all care

Cons

- Limited choice of doctors

- Referrals needed to see specialists

- You pay the full cost of see non-network doctors (emergencies covered)

2. Preferred Provider Organization (PPO)

A PPO gives you more choice of doctors than an HMO.

Pros

- Access specialists without a referral

- Choose any doctor in their network

Cons

- Costs more to see out-of-network doctors

- More paperwork for non-network care

3. Exclusive Provider Organization (EPO)

An EPO works like a PPO but only covers in-network doctors, except for emergencies.

Pros

- No referrals are needed for specialist visits

- Premiums lower than similar PPO

Cons

- No coverage for out-of-network care

- Must use EPO network doctors

4. Point-of-Service Plan (POS)

A POS combines HMO and PPO features.

Pros

- More doctor choice than HMO

- Moderate paperwork for non-network care

- The primary doctor manages the care

Cons

- Need referrals for specialist visits

- Out-of-network care costs more

5. Catastrophic Plan

If under 30, you can get a Catastrophic plan.

Pros

- Lower premiums

- 3 primary care visits before deductible

- Free preventive care

Cons

- Rules may limit specialist access

- You pay a deductible before coverage starts

6. High-Deductible Health Plan (HDHP) With or Without a Health Savings Account (HSA)

An HDHP has lower premiums but you pay more health costs until you reach a deductible.

Types: HMO, PPO, POS, EPO

Pros

- Lower premiums

- HSA option to save for medical expenses tax-free

- Free preventive care

Cons

- Higher out-of-pocket costs until deductible met

- Bronze plans are usually HDHPs

Doctor choice depends on specific plan types. Compare costs vs coverage to see if an HDHP meets your needs.

Steps to Choosing the Best Health Insurance Plan That Fits

Everyone’s health insurance needs are different. To find the best plan for you, follow these steps —

1. Identify Your Health Insurance Needs

First, take a moment to figure out which part of the health insurance market is right for you. Plus, consider if you are eligible for subsidies or federal tax credits, which are key factors in finding the best affordable insurance plans.

If you have pre-existing illnesses, Affordable Care Act (Obamacare) plans might be the most suitable option for you. Besides, for detailed information on ACA plans, you can call 1-800-273-8115. You can also take a look at healthcare reform in the United States for more info.

You may need short-term medical insurance for a period of time when you’re between coverages or deciding. For those over 65 or with a medical disorder, Medicare is probably the best option.

2. Check Health Plan Networks

Next, it’s important to review the network of any healthcare plan you’re considering. It involves checking whether your preferred doctors or hospitals are included in the plan’s network, as this can be a crucial factor for many.

You can reduce costs and spend less out of pocket by choosing a doctor within your health plan’s network. You’re more likely to use the network effectively if you know where you usually receive care is included.

If they’re not, you’ll need to decide if there are other network alternatives that you’re comfortable with.

3. Know the Benefits and Limits

It’s important to closely examine the benefits and limitations of health plans. Along with the truths about health insurance plans, as even similar plans can vary in detail.

So, focus on comparing the aspects that matter most to you.

- First, look at prescription drug coverage. Make sure the plan covers any medications you currently take. Also, find out the cost of each drug. See if you can order prescriptions by mail to save money.

- Next, think about preventive care. If wellness and routine health checks are important to you, look for plans that offer good coverage for regular doctor visits and tests.

- Finally, think about your personal health needs. For example, do you need chiropractic care, mental health services, or medical equipment? Check that the insurance plan covers those specific services. Also, understand any limitations or conditions on that coverage.

4. Understanding Your Health Insurance Costs

It’s important to know that you’ll still have expenses even with health insurance. We’ll explain key terms for health plan costs. These terms show what you pay out-of-pocket all year with insurance:

- Premium: This is the amount you pay regularly (usually every month) for your health insurance coverage.

- Deductible: The amount you pay for care before insurance kicks in. Example: $900 deductible means you pay first $900.

- Copay: It’s a fixed amount you pay for specific services. For instance, you might pay $20 for a doctor’s visit.

- Coinsurance: After meeting your deductible, you’ll pay a percentage of eligible medical costs. It’s often between 20% and 30%. So, for example, you pay 30% of the $50 bill = $15.

- Out-of-pocket max: This is the maximum amount you’ll pay during your plan term for covered expenses. Once you reach this limit, the plan covers 100% of your covered expenses.

Remember, your copays and premium payments usually don’t reduce your deductible.

5. Identifying Additional Coverage Needs

No health insurance plan covers everything, so it’s important to identify and fill any gaps in coverage. Here are some options for additional coverage —

- Dental Insurance: This covers basic dental services like check-ups and cleanings.

- Critical Illness or Accident Insurance: These plans can assist in covering large, unexpected medical expenses.

- Vision Insurance: It helps with the costs of eye exams, glasses, and contact lenses.

Supplemental health plans like these give you the flexibility to enhance your coverage in specific areas based on your needs.

While these five steps are a great starting point, they’re not the only factors to consider when choosing health insurance. It helps you find a plan that meets your needs and eliminates unnecessary plans.

Beware of Unlicensed Health Plans

When selecting a health plan, it’s crucial to understand the differences among your options. Some plans offer extensive coverage, while others might leave you with significant medical bills.

The process of choosing health insurance can be complex, and if a plan seems too good to be true, it often is.

Regarding Discount Plans

It’s important not to confuse discount plans with actual health insurance. These plans charge a monthly fee for reduced fees on health care services. However, they are not insurance – they don’t pay for your health care services but offer discounts on some medical expenses.

As low-cost options, discount plans aren’t health insurance and won’t meet Massachusetts health coverage requirements. So, ensure your discount plan will provide real savings by consulting your doctor or pharmacist.

Plus, avoid sharing your personal information or money with anyone offering health care discounts.

Health Care Sharing Ministry Plans

These plans are for people with shared religious beliefs to collectively cover certain health care costs. They are not insurance and are not regulated by state insurance departments.

Members pay a monthly fee, which allows them to submit eligible medical expenses for sharing among the group. However, these plans lack specific consumer protections, don’t guarantee payments, and often don’t cover the same services as health insurance.

Make Sure You Read the Fine Print

Check if your prescription drugs are covered and where you can find the plan’s network of health care providers. Plus, consider the total cost, not just the monthly premium. Calculate your potential out-of-pocket expenses, including deductibles, copayments, and non-covered items.

High out-of-pocket costs can offset the benefit of lower monthly premiums. Also, ask about the monthly premium, your out-of-pocket costs, any maximum limits, and the deductible amount.

Recognizing Health Insurance Scams

Be wary of health insurance scams, often found online, or through unexpected faxes and phone calls. When browsing the internet, always scrutinize websites. Look out for disclaimers like “this is not insurance” or “not available in Massachusetts.”

Warning signs of a scam include —

- No clear company name or address.

- Requests for personal information.

- Pressuring with a ‘limited time offer’.

- Demanding payment before providing full plan details.

Before committing to a health plan that seems to fit your needs, verify its legitimacy. Check with the Division of Insurance (DOI) website or call them to confirm if the company is licensed to sell insurance in Massachusetts.

Be cautious about sharing personal information or making payments in response to unsolicited contacts.

Remember the rule: Stop. Call. Confirm

If you have doubts about an insurance company, STOP before signing anything or making a payment. Just CALL the DOI, and CONFIRM that the company or agent is legitimate and licensed in your state.

When to Enroll for Health Insurance

When choosing health insurance, you need to enroll during a specific time known as open enrollment. During this period, you can —

- Choose a health plan that suits your needs.

- Change your current health plan.

- Renew your existing plan for the next year.

Open enrollment usually occurs from November to January, varying by health plan and state. This is the time to select your health plan for the upcoming year.

When you have a major life change, like getting married or having a baby, you can adjust your insurance. Also, if you start a new job with health insurance, you’ll have a set time after your start date to enroll in their plan.

Conclusion

And there you have it – a detailed guide to help you figure out which health insurance plan works best for your situation. We covered all the essential factors to consider when making this important choice.

The question is, which health insurance plan is best for me? Well, there’s no one “perfect” plan for everyone. Your budget, health status, doctor preferences, and specific coverage needs determine the right health insurance policy.

Use the checklist we provided to compare your options side-by-side. Your goal is affordable healthcare aligned to your lifestyle without surprises. Use this guide to ask insurers the right questions about care and real expenses. Choosing the best policy isn’t easy, but with our tips, you can find it.